Ankorus | Financial and crypto worlds linked by blockchain technology

The advent of blockchain technology enables the creation of asset-backed tokens, where each token can be pegged according to the appropriate security value stored in the backup. Blockchain technology therefore allows beyond the old geographical barriers to entry. Token can be traded online from anywhere, fast and cheap, and can be sold as a fractional asset, which further reduces the financial barriers to entry. Ankorus wants to build an online exchange based on current financial assets around the world. Various audit actions are being carried out and are being supported by Ankorus. Ankorus prioritises responsive customer service as its core value.

The Anchor Token System seeks to provide alternative investment ecosystem that tokenises and any financial instrument, including stocks, bonds, futures, options, gold, silver, commodities, REITs, ETFs and sovereign debt. When our customers purchase anchor tokens, we will immediately purchase the corresponding asset. Ankorus, as trusted custodian, holds this asset in reserve. Token holders can exchange their Anchor Tokens on the Ankorus token exchange, AnchorNet, or redeem their value directly from us.

Ankorus wants to get to tokenise into Anchor Token any financial asset that's currently available. Ankorus wants to take requests for anchor tokenisation in return for a one-time tokenisation fee.

Ankorus intends to make available for purchase any financial assets currently traded worldwide, such as AMZN, FB, SBUX, BIDU, AAPL, US T-Bills and Bonds, USD, CHF, JPY, SPY, GLD, ZKB Gold, Crude Oil.

How Ankorus Works?

*Pick

Pick Any Financial AssetShares / Stocks

ETFs / Bonds Currencies Commodities

*Pay

Pay with 60+ cryptocurrencies

Bitcoin / Ether Litecoin / Ripple Dash / NEO Monero / Omisego

*recieve

Anchor Tokens Tied to Your Security

Instantly Credited To Your Smart Wallet

*Hold

Trade Transfer Redeem

Ankorus Markets

CREATION OF ANCHOR TOKENS

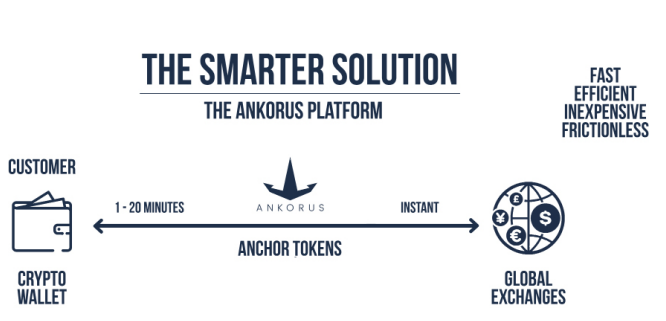

- The customer selects a financial asset to tokenise

- Customer pays Ankorus for their purchase in any one of a number of currencies (this will include BTC, ETH, Ripple's XRP, BCH, Litecoin, Dash, NEO, Tether and ANK).

- The Ankorus broker-dealer purchases the underlying securities, as selected by the customer. Orders are filled at the security's currently traded price.

- The equivalent value of Anchor Tokens for that security is then credited to the customer's account in their smart wallet, minus a small fee and commission. Anchor Tokens wants to be credited to the customer's wallet within minutes of receiving the order.

- Any earnings derived from underlying securities will either automatically be reinvested back into those securities, giving the customer a larger number of anchor tokens, or credited to the customer's wallet. The customer can choose which of the two options they prefer.

Ankorus is the only entity that can create or destroy Anchor Tokens, which maintains their exact value in line with the underlying security.

RISK MANAGEMENT

The Anchor Token system aims to provide a low cost, transparent and expedited facility for the management of financial risk in a number of sectors.

- Crypto Currency

The adoption rate for cryptocurrencies such as bitcoin is still slow due principally to high price volatility and debate around how the technologies are to proceed. Anchor Tokens represent an effective solution to such uncertainties. Cryptocurrency holders seeking to lock them quickly and inexpensively for Anchor Tokens, and then later on simply exchange them back to cryptocurrency again.

- Fund managers, pension portfolios, all major holders of securities

As anchors can be swapped easily for other anchors, via a relative frictionless exchange on AnchorNet.

- Nations with highly volatile currency prices

Individuals in nations with volatile currencies wants to be able to exchange their currencies for the anchor.

If Anchor Tokens are lost or stolen, Ankorus wants to recreate or replace them, thus rendering Ankorus' proprietary technology that allows the quick and effective prevention of losses.

SMART WALLET

Anchor Token holders wants to store their tokens into highly secure and reactive Ankorus smart wallets. Ankorus smart wallets wants to leverage proprietary technology to achieve an uninterrupted level of security in a presently immature and predatory cryptocurrency environment. Vulnerability to hacking is vastly reduced.

Smart Wallets wants to employ Reactive Portfolio Management (RPM), which provides a constant indication of the current value of their Anchor Tokens, in their chosen base currency, and the value of any held Fiat currency. Account statements can be requested.

In the event of fraudulent transfer, RPM technology will automatically trigger the self-destruct algorithm built into Anchor Tokens. Further, each party wants to be made via the annulling of invalid transactions and awarding of replacement tokens.

TRADING ANCHOR TOKENS

Token holders wants to be able to trade their Anchor Tokens for other Anchor Tokens on AnchorNet, our planned proprietary Anchor Token exchange platform (see The AnchorNet Trading Platform) and also on any other available cryptocurrency exchanges.

ACCREDITED BEARERS AND BENEFICIARIES OF ANCHOR TOKENS

The owner of Anchor Tokens is referred to by Ankorus as the Accredited Bearer. The Accredited Bearer wants to be able to redeem Anchor Tokens from Ancorus or trade them on the secondary market, AnchorNet. The Accredited Bearer intends to be the initial purchaser of the Anchor Tokens, a beneficiary of the initial purchaser, or a purchaser of the secondary market AnchorNet.

The Accredited Bearer wants to be able to nominate and identify beneficiaries to whom the Anchor Tokens are bequeathed. Once the Anchor Tokens have been transferred to the beneficiary, the beneficiary becomes the new Accredited Bearer.

ACCOUNT FUNDING

Customers want to pay in their own account or in a traditional fiat currency or cryptocurrency. The currency of redemption will be determined by the currency of account.

Whichever currency is used, both Ankorus and its customers are obliged to adhere to the relevant local regulations regarding financial transactions in that currency

FUND WITHDRAWALS

The Accredited Bearer of Anchor Tokens may speak directly from Ankorus, into their customer account, for the equivalent value of their underlying security.

After Anchor Tokens have been redeemed, or if it is a balance of currency in a customer's account.

MARKETS AND PRICING

Ankorus wants to create both a primary and secondary market for anchor tokens.

Primary Market

Customers buy and redeem Anchor Tokens directly from Ankorus. Orders are filled for customers according to the current market price. Likewise, tokens wants to be redeemed at the current market price.

Secondary Market

Ankorus wants to create an orderly market for secondary trades of all Anchor Tokens. This thesis will be discussed on AnchorNet, to be developed in Phase Three (see Roadmap). Here, customers want to be able to exchange Anchor Tokens for a variety of anchored securities and all cryptocurrencies.

GENERAL LEDGER

Ankorus wants to use a specialized ledger to achieve the necessary high levels of security and trust required for an online exchange.

- The general ledger wants track token creation, possession, transactions and redemptions.

- Rights of token possession wants to be tracked at all times.

- All transactions that occur must be valid transactions, completed by the general ledger.

PROOF OF INTEGRITY

Ankorus wants to employ various mechanisms: To ensure a proper link is maintained between existing Anchor Tokens and their underlying securities, and maintain the requisite transparency of operations;

*We want to be audited by the exchange

*We want to be audited by all the necessary monetary authorities

*We want to invite existing reputable auditors to examine our books

In addition to these measures, Ancorus customers wants to be able to compare the general ledger to compare the total value of securities held. Daily brokerage statement therefore wants to be issued for confirmation of transactions done and securities held.

GLOBAL CUSTODIAN

Ankorus wants to act as the depository for all underlying securities.

- Ankorus, as custodian, wants to ensure through any global exchange.

- A "Proof of Asset" dashboard wants to be maintained in real-time at AnchorNet, enabling complete transparency.

- The Ankorus clearing firm will provide a daily statement, available from Ankorus.

- The custodian wants to insured SIPC.

- The custodian wants to be audited on a regular basis.

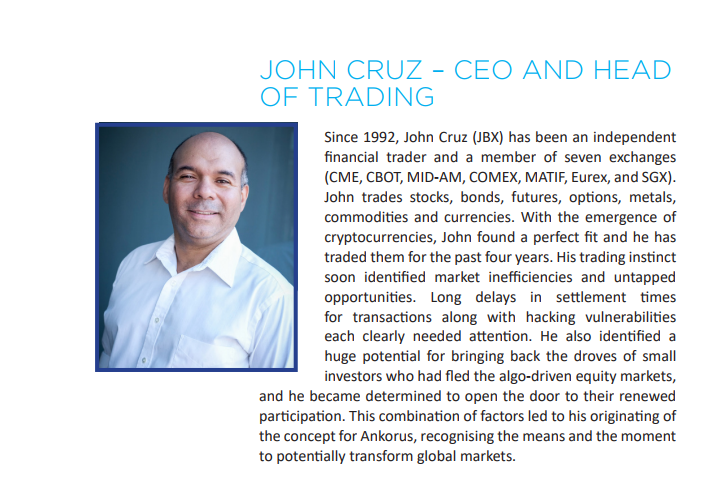

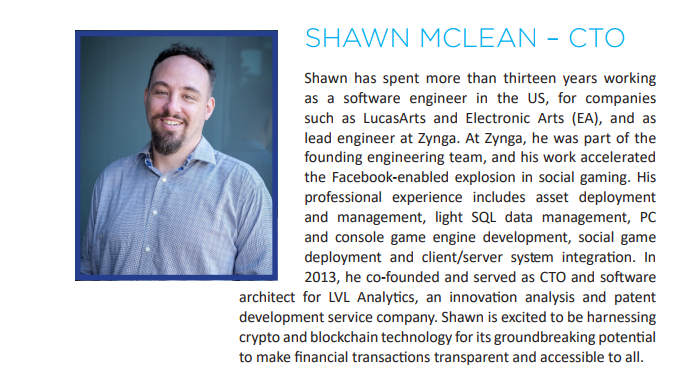

Meet the team

"Everything around you that you call life was made up by people that were no smarter than you. And you can change it, you can influence it. You can build your own things that other people can use. Once you learn that, you'll never be the same again."

For Further Information, You Can Visit Link Below:

Facebook: https://www.facebook.com/Ankorus

Website: https://www.ankorus.org/

Twitter: https://twitter.com/AnkorusGlobal

Linkedin: https://www.linkedin.com/company/Ankorus

Medium: https://www.medium.com/@Ankorus

Reddit: https://www.reddit.com/user/AnkorusGlobal

Telegram: https://www.t.me/Ankorus

Author (supereme 30 to mars)

Bitcointalk link profile: https://bitcointalk.org/index.php?action=profile;u=1217694

Ethereum wallet address: 0xa3B3c84D899898EDffB4C9841B8079D460099242

Komentar

Posting Komentar